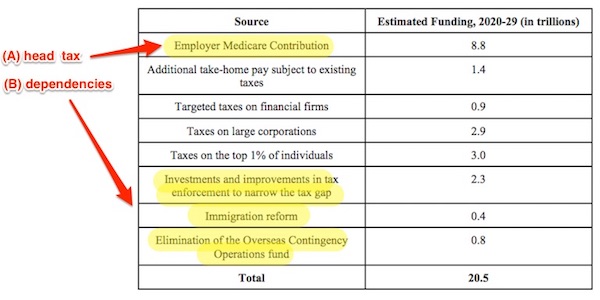

Elizabeth Warren Releases #MedicareForAll "Pay For" Plan, with "No New Taxes" on the "Middle Class" | naked capitalism

PDF) From Double Tax Avoidance to Tax Competition: Explaining the Institutional Trajectory of International Tax Governance

![PDF] Reducing the Tax Gap: The Illusion of Pain-Free Deficit Reduction | Semantic Scholar PDF] Reducing the Tax Gap: The Illusion of Pain-Free Deficit Reduction | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/b7e03e59153f7fc21c75a9aef97a9d8325166045/16-Table1-1.png)